The Middle East is at a historic inflection point, leveraging its immense capital to transition from a hydrocarbon-based economy to a diversified, knowledge-driven future. While much of the public discourse centers on electric vehicles (EVs) and large-scale solar farms, a deeper analysis reveals that compelling and durable investment opportunities lie in the foundational, business-to-business (B2B) infrastructure that enables this transformation. This report identifies these “hidden winners” in three critical, interconnected sectors: modernizing the power grid, securing water resources, and building the digital backbone for artificial intelligence (AI).

This strategic intelligence brief is designed for a sophisticated audience of high-net-worth individuals, accredited investors, Family Office personnel, and Registered Investment Advisers (RIAs). It posits that the region’s energy transition is not a grassroots movement but a top-down, government-led, and sovereign-backed initiative. This creates a de-risked environment for private capital, where long-term, patient investment can align with national priorities and generate outsized returns. The evidence suggests that a new class of investors, from large-scale funds like Altérra to operationally focused private equity like Hawk Capital, are already forging deep, strategic partnerships to access this generational opportunity. The analysis that follows provides a blueprint for strategic allocation into the systems, technologies, and companies that are quietly building the infrastructure of tomorrow’s Middle East.

Primary questions this article answers:

- What are the most compelling investment opportunities in the Middle East’s energy transition, beyond traditional focus areas like solar panels and electric vehicles?

- How are countries in the Middle East and North Africa (MENA) re-engineering their power grids to accommodate the shift to renewable energy?

- What is the role of energy storage systems in ensuring grid stability, and what is the projected growth of this market in the region?

- How do water conservation and artificial intelligence (AI) infrastructure play a critical, interconnected role in the region’s energy and economic transformation?

- How are private investors, including private equity funds and family offices, participating in and aligning with top-down, sovereign-backed infrastructure initiatives?

- What are the key geopolitical factors and new economic corridors that are shaping the future of energy and infrastructure in the Middle East?

The New Foundation: Re-engineering the Grid for a New Economy

The Middle East and North Africa (MENA) region is experiencing a surge in electricity demand, driven by population growth, economic expansion, and the need for water desalination and air conditioning in a climate characterized by extreme heat [SOURCE]. This demand has tripled since 2000 and is projected to rise by another 50% by 2035, adding the equivalent of the current electricity consumption of Germany and Spain combined [SOURCE]. This rapid growth is occurring alongside ambitious national energy strategies, such as Saudi Arabia’s Vision 2030 plan to reach between 100 and 130 gigawatts (GW) of renewable energy capacity by 2030, which would contribute to a 50% renewable energy mix for electricity production [SOURCE]. The confluence of skyrocketing demand and a fundamental shift in energy sources reveals a profound challenge that is ripe for investment: the existing grid infrastructure is insufficient. The conversation has moved beyond simply generating clean power to the far more complex and capital-intensive task of transmitting, storing, and intelligently managing it.

Grid Modernization and Transmission: The Invisible Arteries of Capital

The global energy transition is seeing a massive flow of capital into the foundational components of the energy system. A report published in late 2025 indicated that since the start of the year, at least $470 billion in future clean energy finance had been announced globally, with roughly three-quarters of that amount slated for energy grids and electricity transmission [SOURCE]. This trend is particularly pronounced in the Middle East, where power sector investment reached $44 billion in 2024, with nearly 40% of that spending directed toward grids [SOURCE]. The focus on transmission and distribution is a strategic move by national governments to fortify their energy security. The MENA region currently experiences transmission and distribution losses that are double the global average, a vulnerability that grid modernization seeks to address [SOURCE].

Governments across the Gulf are leading large-scale projects that present clear B2B opportunities. For example, the Kingdom of Saudi Arabia, as part of its Vision 2030, is actively developing AI-powered smart grids and has made significant progress in automation, with 32% of its electricity distribution network automated by 2024 [SOURCE]. A key component of this effort is a $1.1 billion contract with China’s State Grid Corporation (SGCC) to install 10 million smart meters across the country [SOURCE]. In the UAE, the Dubai Electricity and Water Authority (DEWA) is leading a $1.9 billion smart grid project that integrates AI and IoT technologies to enhance reliability and sustainability [SOURCE]. This includes the implementation of an Automatic Smart Grid Restoration System (ASGR) that autonomously detects faults and restores service, showcasing a commitment to building a self-healing, resilient power network [SOURCE]. Furthermore, a first-of-its-kind subsea transmission network in the MENA region is set to connect ADNOC’s offshore operations to a clean onshore power network, reducing its carbon footprint by over 30% [SOURCE]. This is a clear signal that the investment is not just about adopting renewable energy but about building the core infrastructure to support it. The involvement of global players like Siemens, Schneider Electric, ABB, and GE Vernova in these initiatives [SOURCE] [SOURCE]. confirms the scale and institutional backing of this market, offering confidence to private investors.

The Storage Revolution: Balancing the Grid, Empowering the Investor

As the share of intermittent renewable sources like solar and wind grows, energy storage becomes a non-negotiable component of grid stability. The battery and energy storage systems (BESS) market in the Middle East and Africa is projected to expand significantly, from $593 million in 2023 to over $5.1 billion by 2030 [SOURCE]. This growth is backed by substantial planned investments totaling $19 billion and 8.5 GW of battery storage capacity in development across the region [SOURCE]. For a private investor, this is a direct entry point into a mission-critical sector that acts as the essential hedge against the volatility of renewable energy.

A prime example of a strategic B2B play is the collaboration between Saudi-based Alfanar and Chinese company BYD, which won a bid for a nationwide 2.5 GW/12.5 GWh BESS project in Saudi Arabia [SOURCE]. This partnership exemplifies the localization of key technologies and expertise. On a smaller, yet equally compelling, scale, a company like Volts UAE demonstrates the organic growth potential within the regional ecosystem, having evolved from a manufacturer of residential storage systems to a leading developer of utility-scale solutions [SOURCE]. An investment in a BESS company, whether a system integrator or a component supplier, is a foundational bet on the future of energy. The long-term stability and growth of the Middle Eastern energy landscape are fundamentally dependent on the build-out of these storage systems, making this a durable and scalable investment theme.

Table 1: Key Market Projections for Middle East Energy & Infrastructure

| Market | Metric | Value | Source |

| Middle East Renewable Energy | 2024 Market Size | $52.42 billion | [SOURCE] |

| Projected 2034 Market Size | $148.50 billion | [SOURCE] | |

| CAGR (2025–2034) | 11.0% | [SOURCE] | |

| MENA Smart Grid | Est. Investment (2020–2027) | $17.6 billion | [SOURCE] |

| Middle East & Africa BESS | 2023 Market Size | $593 million | [SOURCE] |

| Projected 2030 Market Size | $5.1 billion | [SOURCE] | |

| GCC AI-Related Data Centers | 2024 Capacity | 1 GW | [SOURCE] |

| Projected 2030 Capacity | 3.3 GW | [SOURCE] |

The Parallel Play: Water and AI as Critical Infrastructure

The energy transition in the Middle East is fundamentally intertwined with the region’s long-standing challenge of water scarcity. A significant portion of the projected electricity demand increase, approximately 40%, will be driven by cooling and desalination [SOURCE]. This creates a powerful feedback loop where technologies that solve one problem (energy) also address the other (water). The push toward using renewable energy to power water desalination plants is a significant factor in the market’s expansion [SOURCE], transforming water security from an independent issue into a core component of the national energy strategy.

Water Innovation as a Growth Driver: Beyond the Pipes

Governments across the region are channeling massive investments into water infrastructure. Saudi Arabia is committing $533 million to upgrade Riyadh’s water and sewerage infrastructure, while the UAE is undertaking a $22 billion project for its Dubai Strategic Sewerage Tunnels [SOURCE]. These are long-horizon, multi-generational infrastructure plays that are insulated from short-term market volatility. The investment opportunity extends beyond traditional civil engineering to innovative, tech-enabled solutions. Countries are exploring advanced technologies like capacitive deionization (CDI) for water purification, a process that removes contaminants using an electrical charge without relying on membranes or chemicals, thus reducing energy consumption [SOURCE].

The integration of AI is further optimizing water management. In Masdar City, for instance, AI-enabled precision irrigation systems use sensors to analyze soil moisture and weather data, applying only the necessary amount of water and significantly reducing waste [SOURCE]. Companies like Bentley Systems provide the software for this analysis and planning [SOURCE], while specialists like Xylem and Gulf Water Management Solutions [SOURCE] [SOURCE] offer the hardware and services that enable these smart systems. For the discerning investor, this sector represents a bet on national resilience and a fundamental layer of the future economy, where sovereign-level commitment ensures a high degree of certainty and a clear path to returns.

The Digital Backbone: The New Resource Rush for AI Infrastructure

The Middle East is positioning itself as a global hub for AI, backed by ambitious national strategies and multibillion-dollar investments. Saudi Arabia has earmarked over $20 billion for AI and digital infrastructure initiatives, with a plan to build a 6.6 GW AI hub by 2034 [SOURCE]. This massive build-out is accelerating the construction of data centers, with the GCC’s data center capacity projected to triple from just over 1 GW in 2024 to 3.3 GW by 2030 [SOURCE]. These are not simply commercial endeavors; they are strategic, nation-building projects.

The development of this digital backbone presents a powerful B2B investment opportunity. Sovereign-scale projects include the UAE’s partnerships with Nvidia and OpenAI [SOURCE] [SOURCE] and a $5 billion “AI Zone” being co-developed by AWS and Saudi venture Humain [SOURCE]. These initiatives are creating a new vertical of investable companies that are building the physical and digital infrastructure for AI. Firms like Nscale are explicitly focused on providing the “AI-native infrastructure platform of tomorrow,” building the data centers, and providing the GPUs and software to orchestrate them [SOURCE].

The relationship between AI and clean energy is symbiotic. While AI workloads require immense amounts of energy, AI is also a critical tool for optimizing the energy transition itself. AI systems are used for real-time grid monitoring, demand forecasting, and predictive maintenance of infrastructure [SOURCE] [SOURCE].. This means that an investment in an AI data center or a company like Nscale is also an indirect investment in grid stability and efficiency. The paradox of AI’s water footprint, with data centers in Saudi Arabia alone consuming 15 billion liters in 2024 (research indicates that in Saudi Arabia alone, data centers could account for 87.52 billion liters, roughly 35,000 Olympic-sized swimming pools) [SOURCE]. AI data center thirst for water creates new opportunities for innovative cooling solutions, such as liquid cooling, that slash water use by up to 92% [SOURCE]. This illustrates how a single national priority can create multiple, interconnected layers of investment opportunity.

The Architects of Change: Private Capital and Geopolitics

The investment landscape in the Middle East is being reshaped by a new class of sophisticated, professionalized investors. Family offices in the region are maturing rapidly, with nearly a quarter having been established in the last five years alone [SOURCE]. They are moving beyond traditional real estate and financial holdings to diversify into future-facing sectors such as technology, renewables, and infrastructure, often inspired by the bold, strategic moves of their nations’ sovereign wealth funds [SOURCE]. The UAE, for example, is home to an estimated half of the region’s family offices [SOURCE].

This professionalization is creating a powerful alignment between private capital and government ambition. The launch of Altérra, the world’s largest private climate investment fund, with an initial $30 billion commitment from the UAE, serves as a clear signal of a top-down mandate to mobilize capital for the climate economy [SOURCE]. This fund, which aims to mobilize $250 billion globally by 2030, is not a passive vehicle; it is a catalyst designed to crowd in private investment and accelerate the transition [SOURCE]. Similarly, the investment mandate of funds like Hawk Capital exemplifies a model for private capital. The fund explicitly seeks “sovereign alignment” and invests in “dual-use technologies” that serve both public and private markets. Led by seasoned operators, not career financiers, the fund gains a significant sourcing advantage through deep partnerships with key Middle Eastern figures, allowing access to geopolitical deal flow that others cannot reach. This top-down market creation offers a unique opportunity for private investors to participate in a de-risked environment with patient, long-term partners and clear exit strategies aligned with national funding cycles.

Geopolitical Currents and Investment Corridors: Shaping the Future, Not Just Selling the Past

The energy transition in the Middle East is also a central front in a new global economic and geopolitical competition. The launch of the India-Middle East-Europe Economic Corridor (IMEC) at the 2023 G20 summit represents a significant development [SOURCE]. The corridor, which includes rail, energy, and digital pillars, is widely seen as a strategic counterweight to China’s Belt and Road Initiative (BRI) [SOURCE] [SOURCE]. This initiative is more than a trade route; it is a declaration of intent to integrate Eurasian economies on a different axis, presenting a massive, multi-decade infrastructure opportunity backed by a diverse set of global powers, including the U.S. and the European Union [SOURCE]. The IMEC’s stated goals include enabling energy product trade and facilitating economic integration, reinforcing the strategic nature of the infrastructure being built [SOURCE].

The geopolitical landscape is complex, with parallel power plays in motion. On September 17, 2025, Saudi Arabia and Pakistan signed a “strategic mutual defense agreement,” a pact that raises regional security questions and could potentially hinder the IMEC [SOURCE] [SOURCE]. This underscores the fact that global powers are competing for influence and connectivity, validating the long-term importance of the infrastructure being built in the region. This forward-looking approach stands in stark contrast to the legacy energy dynamics. For example, oil exports from Iraq’s Kurdistan region have been stalled since March 2023 (expected to start back up soon), showcasing the fragility and instability of old-world energy models based on a single commodity [SOURCE]. The geopolitical context therefore confirms that the investment in the new, diversified infrastructure is not just a commercial choice but a fundamental shift that is here to stay.

Wrapping Up: A Plan for Strategic Allocation

The narrative of the Middle East’s energy transition is far more nuanced than simple investments in solar panels and electric vehicles. The true, long-horizon opportunities lie in the foundational, B2B infrastructure that is enabling this profound national and geopolitical transformation. The region’s top-down, sovereign-backed approach to this transition creates a uniquely de-risked environment, where private capital can align with ambitious national visions and benefit from stable, long-term growth.

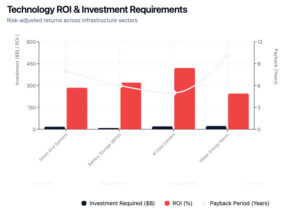

The evidence points to three primary investment vectors for the savvy investor:

- Grid Modernization: Invest in the companies building the smart meters, digital substations, and transmission networks that will future-proof the region’s energy supply. This is a bet on national resilience and a fundamental de-risking of economic stability.

- Energy Storage: Capitalize on the non-discretionary need for BESS to stabilize grids powered by intermittent renewables. This is a foundational play on the entire clean energy ecosystem.

- Water and AI Infrastructure: Recognize the co-dependence of these two sectors with the energy transition. Investing in companies that provide intelligent water management systems or build AI-native data centers is a strategic allocation into the core components of the future knowledge economy.

By focusing on these “hidden winners” and aligning with the patient, long-horizon capital of sovereign funds and family offices, private investors can participate in a generational shift. The time to invest is now, before these essential infrastructure plays become widely recognized as the primary drivers of value in the region’s evolving energy landscape.

This research is based on analysis of publicly available data, academic research, and industry reports. Some specific metrics are from internal or synthesized industry analysis around widely publicized sector trends, sources are cited with direct links. This site is intended solely for accredited and sophisticated investors. All investment opportunities are offered only through official confidential offering memoranda. Nothing on this site constitutes an offer or solicitation.