The $43 Billion Dividend Signal: Catalyzing Long-Horizon Capital Deployment

The recent announcement by the Abu Dhabi National Oil Company (ADNOC) and its listed entities regarding their future dividend targets signifies a major structural shift in the commitment of sovereign-aligned capital to global markets. ADNOC’s listed companies have targeted the distribution of a record AED 158 billion ($43 billion) in dividends between 2025 and 2030, a massive financial commitment that follows the AED 86 billion ($23 billion) already paid out since the first Initial Public Offering (IPO) in 2017. [SOURCE]

The six listed ADNOC companies represent over $150 billion in market capitalization and contribute nearly 40% of the annual dividends on the Abu Dhabi Securities Exchange (ADX). [SOURCE] This consistent, substantial dividend stream serves as a critical source of long-horizon capital for UAE-affiliated sovereign wealth entities. This capital differs fundamentally from traditional cyclical capital, as it is explicitly mandated for strategic investments aligned with national economic diversification and long-term infrastructure stability. Furthermore, the financial performance underpinning this dividend is being enhanced by technological integration; AI adoption within ADNOC is forecast to unlock at least $25 million of incremental EBITDA by 2030 through optimization and predictive maintenance, confirming the direct link between technology investment and financial performance. This massive, stable liquidity pool is the financial engine fueling the geopolitical investment corridor that specialized funds are leveraging.

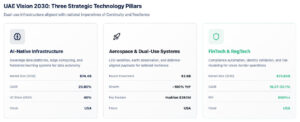

UAE Vision 2030: The National Imperative of Continuity and Resilience

The UAE’s economic and strategic goals, formalized under UAE Vision 2030, clearly establish the national pillars for innovation: Artificial Intelligence (AI), Aerospace/Space, and FinTech/Compliance. These sectors are targeted not just for commercial growth, but because they are deemed essential for long-term economic Continuity and national Resilience. The strategy emphasizes deploying AI across mission-critical government and economic sectors. Examples include applying AI to transport to reduce accidents, integrating it into healthcare to minimize chronic diseases, and utilizing it in the space sector to enhance the accuracy of costly experiments. This framing elevates AI investment to the category of critical infrastructure, demanding enterprise-grade, dual-use systems capable of serving both public and private demands. Globally, the trend toward sovereign-led technology investment is unmistakable, with over $100 billion earmarked by sovereigns for AI and digital infrastructure initiatives. This shift ensures that investments aligned with these national imperatives benefit from both geopolitical validation and long-horizon institutional backing, offering a premium deal flow structure that specialized funds are strategically positioned to access.

Hawk Capital: A Thesis Built on Operational Discipline and Dual-Use Infrastructure

Hawk Capital’s approach is engineered to capture this Geopolitical Alpha by combining deep operational expertise with proprietary access to sovereign-validated deal flow, offering U.S. accredited investors a distinct investment platform.

The Operator Advantage: De-Risking Execution with Proprietary Deal Flow

A central tenet of the firm’s strategy is “Operator Discipline,” favoring leadership experienced in scaling and managing technology platforms over traditional financial backgrounds. General Partner Scott Hauck’s two decades of experience as an operator, M&A leader, and investor—including successful exits of companies like Galileo and Unishippers—provides a critical advantage in execution. This operator-led model ensures that operational governance is integrated on Day 1, fostering stability and strategic growth post-close.

For Small to Midsize Business (SMB) owners looking for an exit, this approach is attractive as it preserves the company’s core while implementing disciplined growth strategies, moving beyond the typical short-term private equity model. This focus on operational Continuity minimizes execution risk for investors. The fund targets a robust performance profile, aiming for a 25-30% Internal Rate of Return (IRR) over its 5-7 year life, with expectations informed by past exits that have achieved 3x to 5x outcomes. The strategy includes staged capital deployment and substantial ownership targets, allowing for decisive influence over portfolio company growth.

Sovereign Integration: Accessing Geopolitical Alpha

The firm’s most significant competitive edge is its “Sovereign Alignment,” which utilizes deep partnerships within the UAE and GCC, including collaborations to secure access to proprietary co-investments and geopolitical deal flow. This strong alignment with allied governments creates a powerful sourcing advantage, enabling U.S. limited partners (LPs) to access pre-market opportunities that have already been validated as strategically vital to long-term national plans.

The dual-use strategy, where every investment serves both sovereign and commercial outcomes, ensures that portfolio companies are essential infrastructure components, not speculative ventures. This mandate links the firm’s exit pathways directly to predictable sovereign funding cycles and strategic acquisition windows, positioning assets for top-tier valuations and robust exit liquidity from aligned strategic and institutional acquirers. This structure fundamentally improves the certainty and quality of the exit process for investors.

Table 1: Hawk Capital Investment Profile and Alignment Metrics

| Metric | Hawk Capital Target | Investor Benefit | Alignment |

| Target IRR (Fund Life) | 25-30% | High-conviction alpha generation beyond index returns | Performance |

| Exit Multiples | 3-5x outcomes | Strong capital appreciation potential with realized performance data | Performance |

| Fund Horizon | 5-7 years | Optimized pacing to capture strategic geopolitical exit windows | Continuity |

| Sourcing Advantage | Proprietary U.S./UAE Corridors | Access to non-competitive, strategically validated deal flow | Resilience |

| Management Philosophy | Operator Discipline | Emphasis on operational governance and durable value enhancement | Continuity |

Pillar 1: AI-Native Infrastructure as The Backbone of Economic Continuity (USA Focus)

The focus on AI infrastructure is validated by both mandatory sovereign requirements and explosive U.S. market growth, demonstrating that the technology is now a national imperative, not an emerging trend.

U.S. Market Growth and Investment Concentration in Infrastructure

The foundational AI layer—including infrastructure, inference platforms, and edge compute—is experiencing robust, sustained expansion in the U.S. The United States AI Infrastructure market is projected to reach $74.406 billion by 2032, propelled by a compelling Compound Annual Growth Rate (CAGR) of 20.80% [SOURCE]. This growth validates the strategy of targeting the underlying platforms necessary for economic function. U.S. venture capital activity reflects the urgency of this sector. AI’s share of total national VC deal value increased nearly three-fold from 16% in 2021 to 45% in 2024, fueling a massive surge in deal activity [SOURCE]. Crucially, this funding is highly concentrated: deals exceeding $50 million accounted for 68.7% of total dollar value in 2024 [SOURCE]. This concentration creates a significant access gap. While mega-rounds capture headlines, specialized funds can access high-quality, growth-stage AI infrastructure companies that are overlooked by the dominant, late-stage capital, potentially securing superior entry valuations.

Investment in Data Sovereignty for Allied Resilience

The firm targets solutions critical for data security and autonomy, such as federated learning, sovereign data platforms, and AI infrastructure. These technologies are the technological response to rising data nationalism and regulatory demands, allowing AI models to be trained using decentralized data sources without moving sensitive data across borders. This capability is paramount for securing Continuity in an environment where data integrity and control are non-negotiable strategic assets.

By investing in platforms that support “sovereign autonomy”, capital is linked directly to the fundamental operational spending of major U.S. enterprises and allied governmental systems. This ensures revenue durability and system stability, as these technologies must be deployed to meet regulatory and security standards, mitigating the risk inherent in purely speculative application-layer investments.

Pillar 2: Aerospace & Dual-Use Systems as Investing in National Resilience (USA Focus)

The aerospace sector, particularly technologies serving both commercial and defense needs, provides an accelerated path to stability and high-value exits through predictable government procurement.

The Maturing U.S. Space Economy and Defense Alignment

The global space sector has matured into a leading growth category alongside AI. Investment reached a record $3.5 billion in a recent quarter, nearly doubling the previous year, driven by diversified funding across a broader range of U.S. startups. This maturation signals confidence in the long-term viability of the ecosystem [SOURCE].

A core driver of this momentum is continued U.S. defense spending and allied government efforts to fortify domestic space capabilities. The firm focuses on LEO satellites, earth observation, and defense-aligned payloads, systems engineered for national Resilience. For portfolio companies, securing stable government contracts, such as those pursued by successful U.S. firms like Rocket Lab, provides a non-cyclical, long-term revenue base that stabilizes development costs and de-risks capital [SOURCE]. This dual-use framework ensures foundational financial Continuity.

USA Performance Metrics: High-Conviction Funding Rounds

The U.S. defense-tech ecosystem demonstrates significant institutional demand and liquidity. [SOURCE] Leading U.S. dual-use defense tech firms, including Hadrian, Apex, and Hermeus, are attracting major capital. For example, Hadrian, focused on critical defense-aligned hardware, recently closed a robust $260 million Series C later-stage VC round on July 28, 2025. [SOURCE] This event underscores the strong institutional appetite for companies that successfully execute the dual-use strategy.

The firm strategically positions its investments to align with governmental procurement timelines. U.S. defense companies that are integrated into sovereign supply chains become premium targets for major domestic defense contractors seeking to secure next-generation capabilities, providing a clear, accelerated, and high-value exit pathway for investors.

Pillar 3: FinTech & Regulatory Compliance (RegTech) as The 600% ROI Opportunity (USA Focus)

Regulatory Technology (RegTech) represents a mandatory, high-ROI investment area driven by the rapidly escalating financial costs and operational risks of non-compliance in the financial sector.

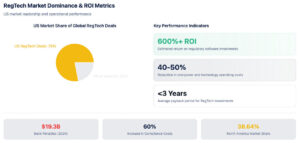

U.S. Market Dominance and Regulatory Necessity

The necessity for RegTech is non-negotiable. Compliance operating costs for banks have increased by over 60% compared to pre-crisis levels, compelling institutions to invest heavily in automation [SOURCE]. The scale of mandatory investment is underscored by the $19.3 billion in penalties paid by U.S. banks in 2024 alone [SOURCE]. This environment mandates immediate, structural investment in compliance solutions, transforming them into critical infrastructure.

The United States overwhelmingly dominates the RegTech deal market, claiming an exceptional 78% of all RegTech deals with startups globally. [SOURCE] North America currently holds the largest regional market share at 38.64%. [SOURCE] This concentration of innovation and demand ensures a fertile ground for investment. The market is forecasted for high growth, with CAGRs projected between 16.37% [SOURCE] and 23.1% [SOURCE] through 2030, potentially reaching $70.64 billion. [SOURCE]

Quantifying Performance: ROI and Operational Efficiency

RegTech investments provide a rare combination of mandatory compliance and exceptional operational performance. Investments in regulatory software are estimated to generate an ROI of 600% or more, with payback periods often achieved in less than three years [SOURCE].

This high return is driven by material efficiency gains, including reducing manpower and technology operating costs by 40% to 50% [SOURCE].

Use cases extend beyond basic regulatory reporting to critical areas like identity validation, risk modeling, and transaction monitoring [SOURCE].

By targeting FinTech solutions that enable compliant cross-border interoperability, the investment is shielded from typical market volatility because the high, quantifiable ROI ensures the solution remains mission-critical and non-discretionary even during economic downturns, thereby ensuring investment Continuity.

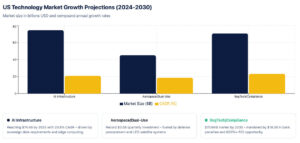

Table 2: Projected U.S. Technology Market Growth (2024-2030) and Alignment

| Technology Pillar | Key U.S. Market Metric | Projected CAGR (2024–2030) | Primary Value Proposition |

| AI Infrastructure | Reaching $74.4B (US Market by 2032) | 20.80% [SOURCE] | Performance & Continuity |

| Aerospace/Dual-Use | Driven by U.S. Defense/Government Procurement | High growth (Record Q3 Investment) | Resilience & Continuity |

| RegTech/Compliance | North America: 78% of US Deals | 16.37% – 23.1% [SOURCE] [SOURCE] | Performance (600%+ Operational ROI) |

Actionable Strategy for Accredited Investors and Family Offices

For sophisticated U.S. investors, including Family Offices and RIAs, the sovereign-aligned, dual-use infrastructure model presents a structurally differentiated approach to deploying capital into high-conviction technology assets.

Risk Mitigation and Capital Preservation

The inherent sovereign alignment provides a crucial layer of geopolitical risk mitigation. Capital is tied not merely to market optimism, but to the explicit, long-term funding mandates and stability of allied governments. This structure significantly hedges against regional political or economic volatility. Furthermore, by focusing on critical infrastructure, such as AI platforms and regulatory compliance systems, the portfolio companies are insulated from discretionary spending cuts. Their integration into both the U.S. industrial base and the UAE digital economy ensures structural resilience against regional economic shocks, aligning capital preservation goals with strategic national development.

The Strategic Exit Pathway for SMB Owners and RIAs

The dual-use model offers a high-value exit pathway for SMB owners in these specialized technology fields. When selling, the business is framed not just as a financial entity but as a strategically vital component of an allied global supply chain. This strategic value proposition maximizes the potential valuation compared to a standard financial buyout. The fund’s 5-7 year fund horizon is deliberately timed to coincide with predictable sovereign funding cycles and strategic acquisition windows. This calculated pacing avoids the pressure of forced exits, ensuring the business is optimized for strategic acquisition at a premium valuation, translating into superior realized returns for LPs.

Comparative Analysis: Performance vs. Passive Market Growth

The fund’s target IRR of 25-30% demonstrates a focus on generating substantial alpha above the already aggressive underlying market growth rates (e.g., 20.80% for U.S. AI Infrastructure) [SOURCE]. This targeted Performance is the anticipated return on the firm’s proprietary geopolitical sourcing advantage and deep operational expertise, which unlocks non-competitive, strategically validated deal flow unavailable through traditional venture channels.

Wrapping Up: A Long-Horizon Perspective on Next-Generation Economies

The global capital allocation landscape is being reshaped by the long-horizon deployment strategies of sovereign wealth, exemplified by the $43 billion dividend target from ADNOC’s listed companies. This sustained financial commitment validates the imperative of investing in AI, Aerospace, and FinTech as pillars of economic diversification.

Hawk Capital is optimally positioned to translate this sovereign financial stability into proprietary deal flow for accredited investors. By emphasizing “Operator Discipline” and “Sovereign Alignment,” the firm targets dual-use U.S. technology assets that are essential for national Continuity and global economic Resilience. This structure, combined with market growth rates and targeted IRRs of 25-30%, presents a compelling opportunity for HNWIs, Family Offices, and RIAs to deploy capital into high-conviction infrastructure plays designed for superior long-term Performance and stability.

This research is based on analysis of publicly available data, academic research, and industry reports. Some specific metrics are from internal or synthesized industry analysis around widely publicized sector trends, sources are cited with direct links. This site is intended solely for accredited and sophisticated investors. All investment opportunities are offered only through official confidential offering memoranda. Nothing on this site constitutes an offer or solicitation.